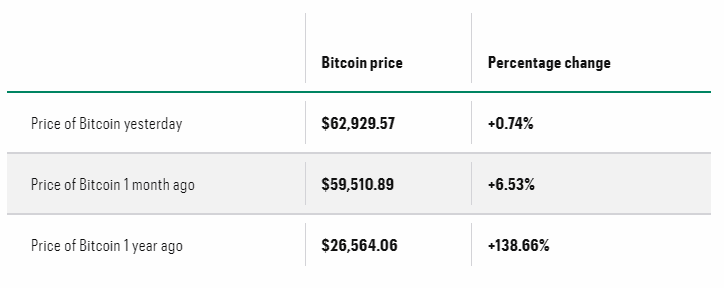

Bitcoin, the first and foremost cryptocurrency, maintains its lead in the market with a market cap surpassing $1.1 trillion. Yet, Bitcoin shares the common trait of extreme volatility with other cryptocurrencies. At 9 a.m. ET today, the bitcoin price (1 BTC) stands at $63,397.72, a significant fluctuation of $62,929.57 compared to yesterday’s value.

Bitcoin More Than Just a Payment

While Bitcoin was initially designed as a digital payment system, its potential as an investment asset has taken center stage. Many people now consider Bitcoin a valuable addition to their portfolios, similar to saving in a traditional IRA.

As a decentralized digital asset, Bitcoin offers a unique investment opportunity. It’s appealing to those seeking diversification and a hedge against inflation. Bitcoin’s impressive growth and outperformance compared to major stock market indices have made it a compelling alternative for investors.

Historical Bitcoin Price

Compared to blue chip stocks like Pfizer, Nike, or Nestle, Bitcoin is quite young. It was launched in 2009, and its price has skyrocketed.

In 2010, Laszlo Hanyecz, a software developer and an early believer in Bitcoin’s value, famously paid 10,000 Bitcoins for pizza. Today, those coins would be worth over $580 million.

Since then, Bitcoin’s price has continued to climb. At the beginning of 2024, its price was $44,187. By March 2024, its price reached its highest level ever, surpassing $73,079.

“The potential benefits of investing in crypto are potentially higher returns than a more traditional stock and bond portfolio may yield on its own,” said Drew Feutz, a certified financial planner (CFP) with Migration Wealth Management.

However, Bitcoin price often experiences price fluctuations and dips. As of September 2024, its price had dropped to about $58,000.

What factors impact the price of Bitcoin?

Bitcoin’s prices rise and fall for a variety of reasons. While the price of stocks can fluctuate based on company performance or industry news, Bitcoin is affected by other factors:

- Bitcoin use: When a major company announces that it will begin accepting Bitcoin as a payment method, Bitcoin price tends to increase. In the past, Bitcoin’s price has increased significantly after companies Tesla, Ferrari, and Dell announced Bitcoin as an acceptable payment method.

- Economic conditions: Generally, Bitcoin isn’t affected as much by inflation or interest rate changes as stocks. However, cryptocurrencies usually perform well when the economy is in good shape. When people are relatively comfortable and feel confident in their financial stability, they’re more willing to invest in alternative assets. When the economy is in decline, people take fewer risks and may decrease how much they invest in Bitcoin and other cryptocurrencies.

- Regulatory activity: Because cryptocurrency is so new, regulations haven’t kept up. As the government outlines new laws and regulations, investors may become more wary of Bitcoin price.

How to invest in Bitcoin

Investing in Bitcoin can take different forms.

Buy Bitcoin directly through a cryptocurrency exchange

Buying Bitcoin directly is one of the most popular ways to invest in cryptocurrency. You can buy Bitcoin by opening an account with a cryptocurrency exchange. You can sync the account with your bank account and use your money to buy Bitcoin.

Invest in a Bitcoin IRA

Another way to invest in Bitcoin is to open a Bitcoin IRA. A Bitcoin IRA is a tax-advantaged retirement account that allows you to invest in Bitcoin and other cryptocurrencies. Bitcoin IRAs have the same tax benefits and contribution limits as traditional or Roth IRAs, but you can invest in alternative assets.

Consider cryptocurrency ETFs

A relatively new way to invest in Bitcoin is through a crypto exchange-traded fund (ETF). With these ETFs, you don’t directly own Bitcoin price, but the performance of the ETF will reflect Bitcoin’s performance.

Crypto ETFs allow you to buy and sell shares through an investment brokerage account, without the need to worry about storage for cryptocurrency or opening a separate cryptocurrency exchange account.

Invest in cryptocurrency-related stocks

For those wary of investing directly in Bitcoin, another option is to invest in cryptocurrency-focused stocks. Potential options include publicly traded cryptocurrency exchanges, technology firms, and payment processors; these companies may use Bitcoin or use it in their operations, so you’ll indirectly benefit from Bitcoin’s performance.

Is it a good time to invest in Bitcoin?

Bitcoin is still a relatively new asset, but it has displayed impressive past performance, and more and more companies are using it or accepting it as a payment method. As Bitcoin becomes more established, it may experience fewer fluctuations in price too.

Bitcoin price volatility is steadily decreasing over the years,” said Brady Swensen, co-founder and head of product marketing at Swan Bitcoin. “As a far more liquid asset, its price volatility is lower than relatively illiquid cryptos.”

If you plan on holding onto your investment for the long haul, investing money into Bitcoin could be a good choice.

“It’s always a good time to invest in Bitcoin with a long-time horizon, [such as] 10 or more years,” said Swensen. “Cryptos are for gambling, not investing.”

Current Cryptocurrency Bitcoin Price

Although Bitcoin is the most well-known cryptocurrency, it’s not the only investment option you have. When deciding where to invest your money, consider these alternatives:

Ethereum:

After Bitcoin price, Ethereum is the second-largest cryptocurrency. Unlike Bitcoin, which is mainly used as digital currency, Ethereum is more than that. It was built as a decentralized platform for developers to create apps and smart contracts, making it a popular tool in the tech world.

Tether:

Tether is a type of cryptocurrency known as a stablecoin. Its value is tied to the U.S. dollar, so it doesn’t fluctuate as much as other cryptocurrencies like Bitcoin. While it’s more stable, Tether doesn’t offer the same growth potential as Bitcoin.

Binance Coin:

Binance Coin is the native cryptocurrency of the Binance exchange, the world’s largest in trading volume. You can use Binance Coin to trade other cryptocurrencies, pay fees on Binance, or even for payments in some cases.

The Takeaway

Bitcoin has had an impressive run, even with some major price drops. Over the last 15 years, its value has soared. As more businesses embrace Bitcoin and it becomes a widely accepted form of payment, there’s room for even more growth.

That said, cryptocurrencies like Bitcoin price are known for being volatile and risky. Since Bitcoin is relatively new, it’s hard to predict how it will perform in the long run. It’s best to only invest money you don’t need right away. To protect yourself, make sure you have a diversified portfolio so that if Bitcoin’s price takes a hit, your other investments can help balance things out.

I recommend keeping your crypto investments to 5% or less of your total portfolio, advises Feutz.

Check More

- Will Cryptocurrency Be The Future Of Money In 2024 – 2025

- XRP Price Explodes $40 Could Be the Next Big Thing

- Cryptoverse: ETF Traders Anticipate Ether Frenzy

- Taiwan C.bank Says No Timetable For Launching Digital Currency