Ubisoft administrator fees are an essential aspect of the company’s financial structure, impacting its operational efficiency and management costs. As a leading global video game company, Ubisoft Entertainment S.A. has established a strong presence in the gaming industry with well-known franchises like Assassin’s Creed and Far Cry. However, understanding these fees, alongside the company’s stock performance, is crucial for investors and industry analysts. These financial elements play a significant role in Ubisoft’s overall business strategy and market positioning, influencing its profitability and growth prospects.

In this blog, we explore Ubisoft administrator fees, stock price trends, financial data, and other essential information for investors.

1. Overview of Ubisoft’s Stock (UBSFF)

Ubisoft Entertainment S.A. is traded under the ticker UBSFF in the OTC market and UBI.PA on the Euronext Paris Stock Exchange. Ubisoft’s stock price has experienced notable fluctuations due to several factors:

- Game Release Cycles: Stock prices tend to rise when major games like Assassin’s Creed are launched and fall during game delays or underwhelming releases.

- Financial Performance: Ubisoft’s stock performance has also been influenced by broader financial results, which include administrative costs, development expenditures, and overall revenue growth.

2. Ubisoft Administrator Fees

In terms of Ubisoft Administrator Fees, like any large corporation, incurs a range of operating and administrative expenses to support its day-to-day business functions. These fees typically include:

- Corporate Governance Costs: This includes fees paid to the board of directors, executives, and company administrators. These costs cover the oversight and strategic decision-making functions critical to the company’s growth.

- Legal and Compliance Fees: Ubisoft must adhere to various regulations as a publicly traded company. This includes legal fees, audit fees, and compliance-related expenses, especially as Ubisoft operates across different regions globally.

- General Operating Expenses: Salaries for administrative staff, rent, utilities, and other general expenses are also categorized under administrative fees. Ubisoft’s administrative structure is large, reflecting its multinational operations.

While these fees are not typically detailed in financial reports as “Ubisoft Administrator Fees ” per se, they fall under operating expenses (OPEX) in financial statements. For investors, it’s crucial to monitor Ubisoft’s operating expense ratio (OER) to understand how efficiently the company is managing its overhead costs relative to its revenue.

How are Ubisoft administrative fees related to its stock performance?

High administrative costs can influence investor perception of Ubisoft’s profitability and efficiency, which may impact its stock performance. If investors believe the company is spending too much on management fees without delivering adequate returns, it could lead to a decline in stock value.

Should investors consider Ubisoft administrator fees before investing?

Yes, investors should consider Ubisoft administrator fees as part of their analysis of the company’s financial health. These fees contribute to overall costs, which can affect profit margins. A careful review can help investors assess whether Ubisoft’s spending is aligned with its long-term growth strategy.

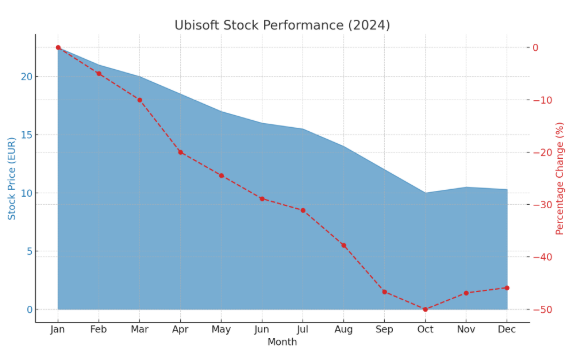

3. Historical Stock Prices and Market Trends

Ubisoft’s stock price has seen both highs and lows over recent years, reflecting its growth and challenges in the competitive gaming landscape.

- Highs: Stock prices tend to peak during the launch of blockbuster titles such as Assassin’s Creed and The Division, or during successful acquisitions or partnerships. For example, the release of Assassin’s Creed Valhalla led to a significant stock price increase in 2020.

- Lows: Delays in anticipated game launches or underperformance in key titles, such as the much-delayed Skull & Bones, have negatively impacted Ubisoft’s stock in the past.

Investors can view historical price charts on financial platforms like Business Insider, Yahoo Finance, and Bloomberg to track these trends and identify the best investment windows.

4. Financial Estimates for Ubisoft Entertainment S.A

Ubisoft’s financial estimates are based on several key factors, such as:

- Revenue Growth: With strong intellectual properties, Ubisoft has experienced consistent revenue growth, though delays and operational challenges occasionally impact these numbers.

- Earnings Per Share (EPS): Ubisoft’s EPS fluctuates with the release of major titles and investments in game development.

- Price Targets: Analysts have varying price targets for Ubisoft stock, with a cautious outlook due to high operational costs but optimism surrounding the company’s future game releases and expansions.

5. Key Financial Data: Income Statements and Balance Sheet

Income Statement (in Mio. EUR)

As of the most recent fiscal year:

| Income Statement (in Mio. EUR) | Amount (EUR) |

|---|---|

| Total Revenue | €1,731 million |

| Operating Income | €117 million |

| Net Income | €79 million |

These numbers showcase Ubisoft’s ability to generate substantial revenue from its game portfolio, though operational costs, including administrative fees, have an impact on net income.

| Balance Sheet (in Mio. EUR) | Amount (EUR) |

|---|---|

| Total Assets | €4,682 million |

| Total Liabilities | €1,626 million |

| Shareholders’ Equity | €3,056 million |

The company maintains a solid balance sheet, which demonstrates its ability to manage debt and invest in future projects.

6. Dividend Policy

While Ubisoft Entertainment S.A does not have a strong history of paying dividends, the company may choose to reinvest profits back into game development and acquisitions rather than return cash to shareholders. Investors looking for dividend income may need to focus on other stocks, while those looking for growth might find Ubisoft Administrator fees a suitable option due to its aggressive expansion strategy.

7. Upcoming Events and Catalysts

Ubisoft frequently holds shareholder meetings, earnings reports, and other significant events. These include product showcases like Ubisoft Forward, where the company reveals new titles and updates on existing projects.

Key Past Events:

- Earnings Calls: Ubisoft’s quarterly earnings are critical for investors, offering insights into how well the company is managing both revenue and operational expenses.

- Game Launches: The release of major titles often has a direct impact on stock performance. For instance, the highly anticipated release of Assassin’s Creed Mirage has potential to be a strong catalyst for the stock.

Frequently Asked Question’s

What are Ubisoft administrator fees?

Ubisoft administrator fees refer to the costs associated with the management and operation of Ubisoft Entertainment S.A. These fees include expenses for executive compensation, corporate governance, and general administration costs that ensure the smooth functioning of the company.

How do Ubisoft’s administrator fees impact its financial performance?

Administrator fees impact Ubisoft's overall financial health by affecting operating costs. While necessary for running the company, high administrator fees can reduce profitability. Monitoring these fees is essential for understanding Ubisoft’s cost management and operational efficiency.

Why is Ubisoft's stock performance important for investors?

Ubisoft's stock performance is a key indicator of how investors view the company's future growth potential. The stock price reflects investor sentiment, market trends, and the company’s ability to execute its business strategy, including new game releases and innovations.

How do Ubisoft’s game launches influence its stock performance?

Ubisoft's stock performance is heavily influenced by new game launches. Popular game franchises like Assassin's Creed or Far Cry can lead to increased revenue, boosting stock value. Conversely, underperforming games can negatively impact the stock price.

How are Ubisoft’s administrative costs related to its stock performance?

High administrative costs can influence investor perception of Ubisoft's profitability and efficiency, which may impact its stock performance. If investors believe the company is spending too much on management fees without delivering adequate returns, it could lead to a decline in stock value.

What factors affect Ubisoft’s stock performance besides administrator fees?

In addition to administrative costs, factors like game sales, market competition, global economic conditions, technological advancements, and the company’s strategic decisions, including mobile and cloud gaming, also play a role in Ubisoft’s stock performance.

Should investors consider Ubisoft's administrator fees before investing?

Yes, investors should consider Ubisoft's administrator fees as part of their analysis of the company's financial health. These fees contribute to overall costs, which can affect profit margins. A careful review can help investors assess whether Ubisoft’s spending is aligned with its long-term growth strategy.

Can Ubisoft’s stock performance be predicted?

Like all stocks, Ubisoft's performance is subject to market fluctuations and external factors, making it difficult to predict accurately. However, understanding its administrator fees, financial health, and market position can help investors make informed decisions. Always consult with a financial advisor before investing.

Conclusion

Investing in Ubisoft Entertainment S.A. requires careful analysis of its stock performance, Ubisoft administrator fees, and upcoming game launches. While administrative fees are a necessary part of the company’s operations, Ubisoft’s overall financial health and growth prospects make it an interesting option for investors who are willing to navigate the volatility of the gaming industry.

As Ubisoft Administrator Fees continues to innovate in areas like free-to-play games, mobile platforms, and cloud gaming, its stock performance will likely reflect these developments. Always consult with a financial advisor before making any investment decisions.

Disclaimer: The above blog is for informational purposes only and does not constitute financial advice.

Check More

- How to Unlock Ubisoft Connect’s Lost Crown Test Version and Recover Your Password Easily

- Augmented Intelligence to Improve Suicide Care: A Game Changer for Mental Health Support

- Unlock Your Creativity with Gramhir.pro AI Image Generator

- Forecasting the Business Value of Artificial Intelligence Worldwide (2017-2025)

- Global Artificial Intelligence Revenue Growth in Markets from 2016 to 2025